mississippi state income tax rate 2021

14 hours agoThe Mississippi income tax accounts for 34 of state revenue. The Mississippi Department of Revenue is responsible for publishing.

These Are The States With The Lowest Costs Of Living Retirement Locations Cost Of Living States In America

Your average tax rate is.

. Alabama a b c 200 0. Taxable and Deductible Items. The Mississippi tax rate and tax brackets are unchanged from last year.

Mississippi personal income tax rates. However the statewide sales tax of 7 is slightly above the national average. The Mississippi state government collects several types of taxes.

She leverages this background as a fact checker for The Balance to ensure that facts cited in articles are accurate and appropriately sourced. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Single married filing separate.

Overall state tax rates range from 0 to more than 13 as of 2021. Tax Rates Exemptions Deductions. If youre married filing taxes jointly theres a.

2021 State Income Tax Rates and Brackets. Examples are 120 for 6000 190 for 9500 240 for 12000 If no exemptions are claimed enter 000. Detailed Mississippi state income tax rates and brackets are available on this page.

Tax rate used in calculating Mississippi state tax for year 2021. Any income over 10000 would be taxes at the highest rate of 5. Your 2021 Tax Bracket to See Whats Been Adjusted.

Multiply the result by 2. Overall state tax rates range from 0 to more than 13 as of 2021. Our calculator has been specially developed.

Ad Compare Your 2022 Tax Bracket vs. Discover Helpful Information and Resources on Taxes From AARP. Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1.

These rates are the same for individuals and businesses. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. The graduated income tax rate is.

Almost unnoticed however were a. 4 on the next 5000 of taxable income. Divide the dollar amount in Item 6 of the state certificate by 100.

Additionally the 4 percent bracket includes 5000 of taxable income meaning potential savings would amount to a maximum of 200 per year for single and joint filers. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Mississippi Salary Tax Calculator for the Tax Year 202122.

0 on the first 2000 of taxable income. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. 4 on the next 5000 of taxable income.

Mississippi has a graduated tax rate. In Mississippi the 4 percent bracket applies to workers earning approximately 13300already a very large portion of the labor force. Discussions over taxes specifically the state income tax dominated this legislative session.

The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202122. The Mississippi State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Mississippi State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Location is everything if you want to save a few income tax dollars. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Mississippi Income Tax Calculator 2021 If you make 140000 a year living in the region of Mississippi USA you will be taxed 34924. Wealthy people would see the biggest financial boost from eliminating the income tax because theyre the ones paying the most now. State Individual Income Tax Rates and Brackets 2021 Single Filer Married Filing Jointly Standard Deduction Personal Exemption.

There is no tax schedule for Mississippi income taxes. Learn about Mississippi state tax rates rankings and more. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

3 on the next 3000 of taxable income. Learn about our editorial policies. If youre married filing taxes jointly theres a.

400 1000. 5 on all taxable income over 10000. The most significant are its income and sales taxes.

State Rates Brackets Rates Brackets Single Couple Single Couple Dependent.

Tax Rates Exemptions Deductions Dor

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

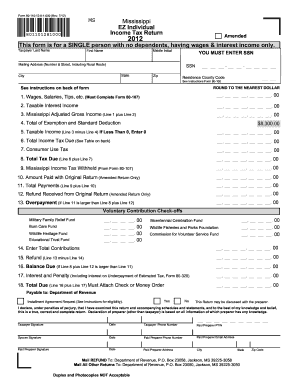

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

The Top 7 Mississippi Veteran Benefits Va Claims Insider

Mississippi House Of Representatives Votes To Eliminate Income Tax Supertalk Mississippi

Mississippi Income Tax Calculator Smartasset

Mississippi State Tax H R Block

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Where S My Refund Mississippi H R Block

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

Tax Rates Exemptions Deductions Dor

Mississippi Tax Rate H R Block

Populist Movement Stations Bryan Cross Of Gold Omaha Platform Farmers Alliance In 2021 Social Studies Projects High School Lessons History Lesson Plans

Mississippi Sales Tax Small Business Guide Truic

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep

Filing Mississippi State Tax Returns Things To Know Credit Karma Tax