ct sales tax registration

Find your Connecticut combined. Connecticut Department of Revenue Services.

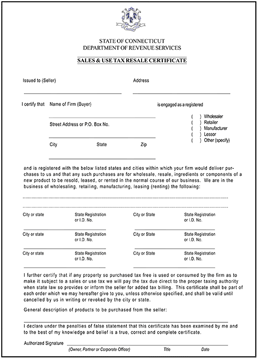

Credit Applications Tarantin Industries

Online Registration Application - Connecticut.

. Taxes under your current Connecticut tax registration number. If you do not have a Connecticut Tax Registration Number or need to register additional locations register your business online. 1 Register online at the MyConnectCT.

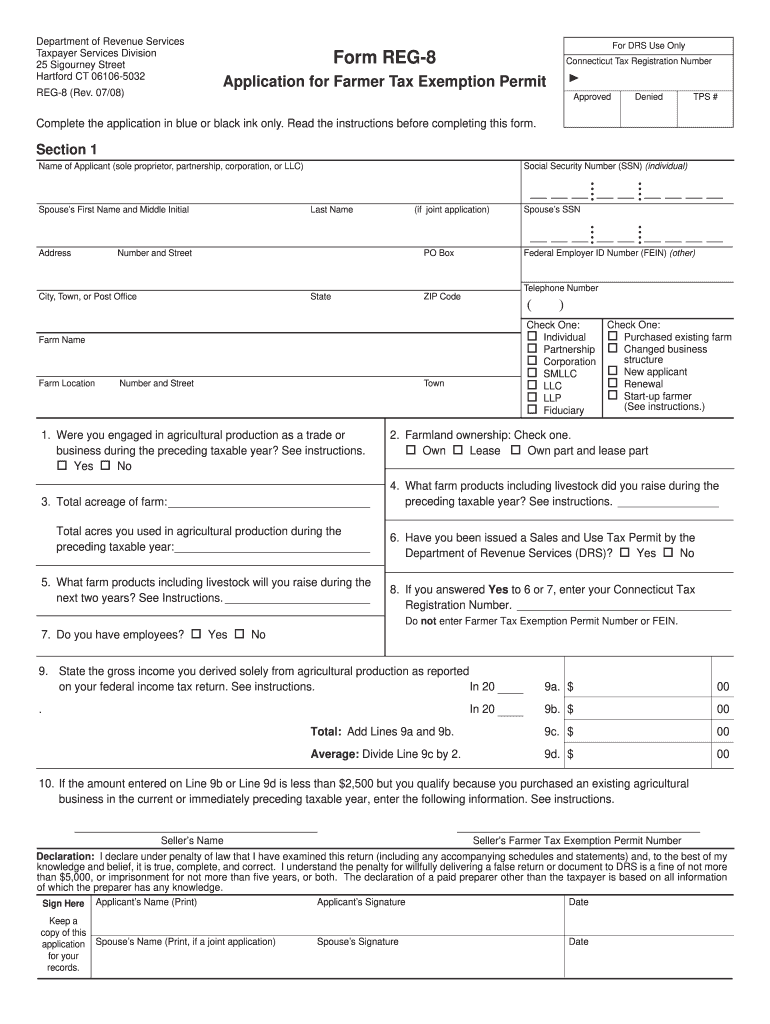

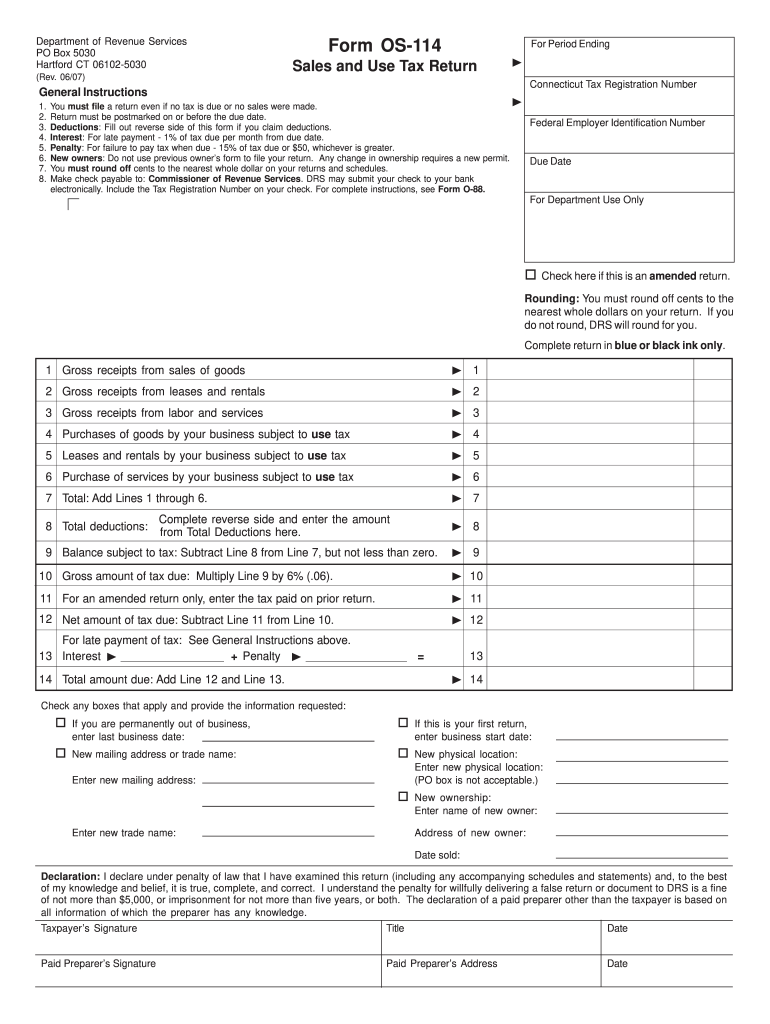

A business not required to register to collect sales and use tax should still register to pay business use tax. Use Form REG-1 to register for any of the following taxes. Department of Revenue Services State of Connecticut PO Box 2937 Hartford CT 06104-2937 Rev.

The minimum is 635. Using Back Button of the browser that is not. You may register for most taxes online using the Taxpayer Service Center TSC.

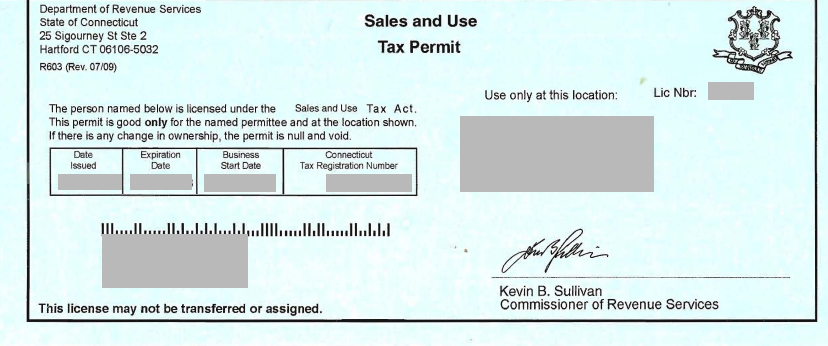

If you have questions about the sales tax permit the Connecticut Department of Revenue Services has a guide to sales taxes in Connecticut or can be contacted by calling 800. You have several options to register for your Connecticut sales tax permit. Identify all your licensing and registration requirements to start your business.

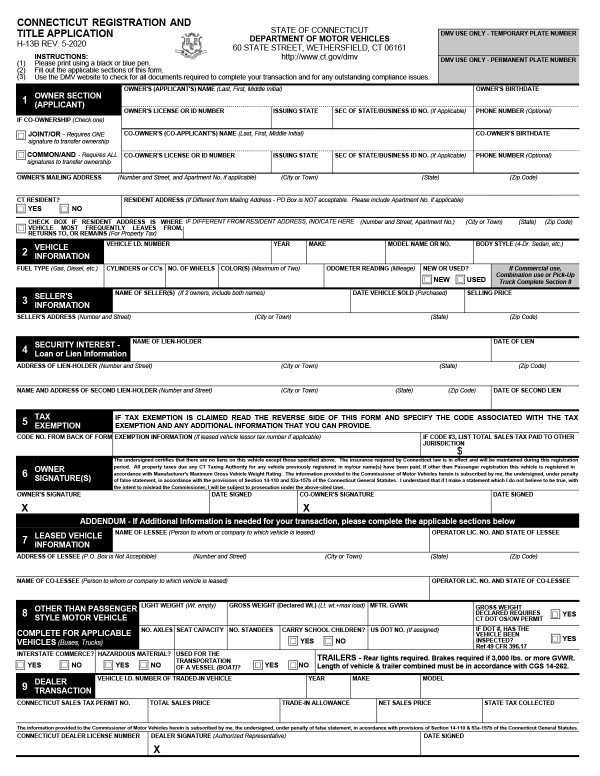

To calculate the sales tax on your vehicle find the total sales tax fee for the city. Department of Revenue Services. 2 Fill out form REG-1 and remit it along with a check for.

This website lists tax deed sales not tax lien sales. This section applies to businesses that are applying for a license in Connecticut for the first time. Either your session has timed-out or you have performed a navigation operation Ex.

Local tax rates in Connecticut range from 635 making the sales tax range in Connecticut 635. If you are required to obtain a new Federal Employer Identification Number FEIN in connection with the change in business structure you will also be required to obtain a new Connecticut tax registration number. How to Calculate Connecticut Sales Tax on a Car.

MyconneCT is the new online hub for business tax needs. Connecticut Department of Revenue Services - Time Out. 100 for sales and use tax.

There are no county or municipal sales taxes in Connecticut. According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales tax or 775 percent sales tax on vehicles over 50000 upon the purchase. Business Taxes Registration Application.

The base state sales tax rate in Connecticut is 635. When you register online with the CT Department of Revenue Services or inperson at a local field office you will immediately get a temporary sales tax permit so you can begin operations. If you register online and there is a fee you must make direct payment from your savings or checking.

To obtain a Sales and Use Tax Permit see Taxpayer Service Center - Registration Application Information ctgov. Registering online provides several key. Connecticut State Department of Revenue Services HOLIDAY - The Department of Revenue Services will be closed on Monday October 10 2022 a state holiday.

Registration occurs at the auction. Business Entity Tax Business Use Tax Corporation Business Tax. If purchases are made in connection with a trade occupation.

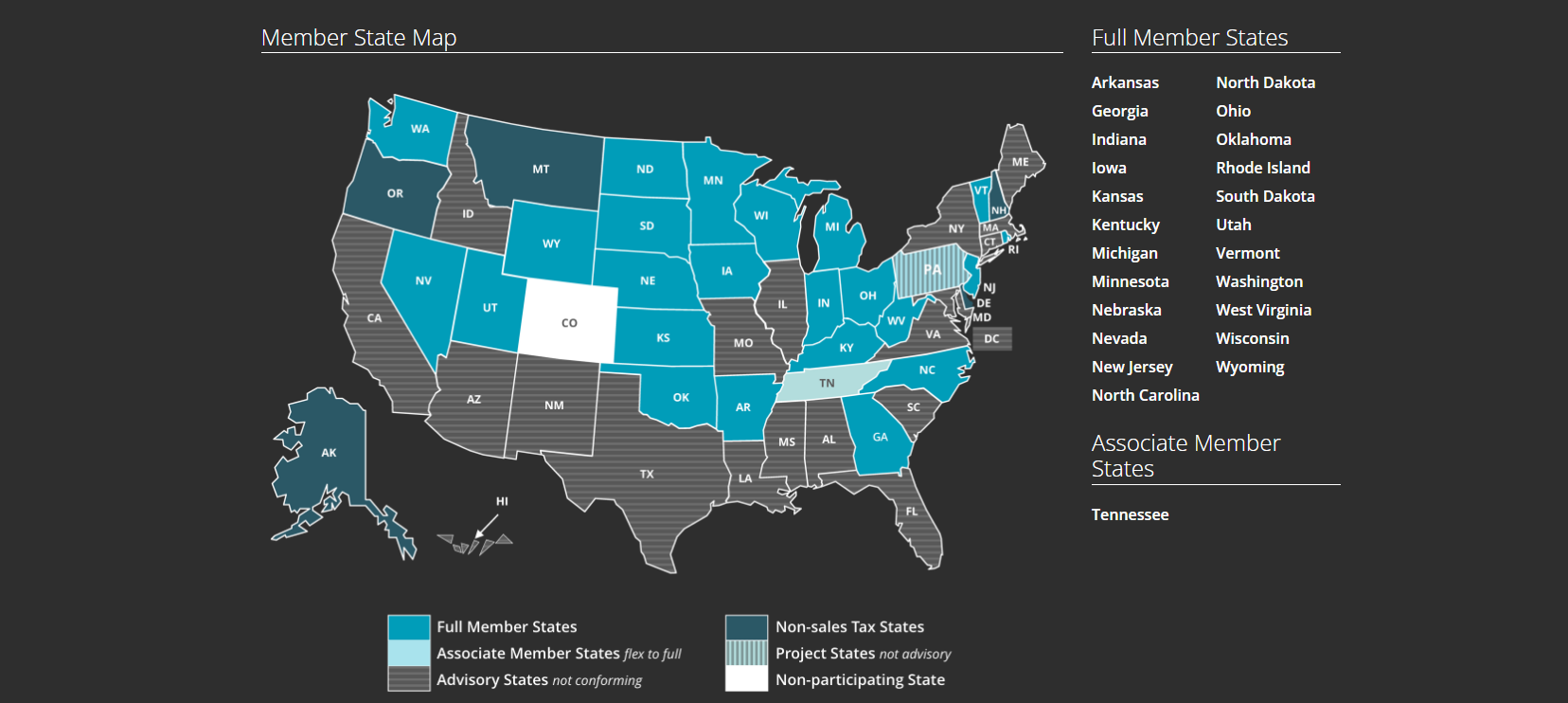

Only the Connecticut Department of Revenue Services can issue Connecticut tax registration numbers for sales tax withholding. Now you can file tax returns make payments and view your filing history in one location. Contact the Connecticut Business Hotline at the Connecticut Economic Resource Center by calling 800.

This means that you are bidding to buy the property itself rather than the right to foreclose it in court. Reason for Filing Form REG-1 Please check the applicable box. Visit myconneCT now to file pay and.

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Connecticut Bill Of Sale Templates And Registration Requirements

Used Honda Civic For Sale In Newington Ct Edmunds

State And Local Sales Tax Rates Sales Taxes Tax Foundation

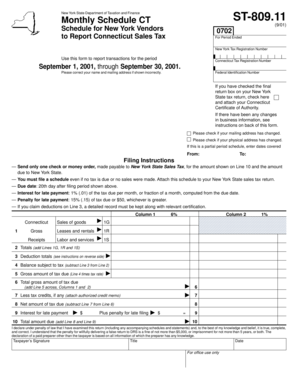

20 Printable How To Write A Monthly Sales Report Sample Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Checklist For Starting A Business In Ct Score

Synmac Consultants Company Registration Consultants Service Tax Sales Tax Tin Vat Return Fillings Firm Regi Cost Accounting Inventory Accounting Company

Ct Senate Republicans Call For Sales Tax Reduction Connecticut Senate Republicans

Connecticut U S Small Business Administration

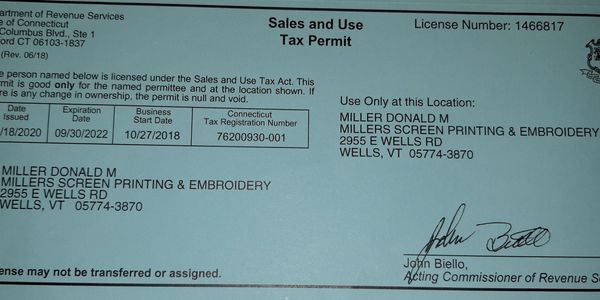

State Cuts Sales Tax Permit Period To Two Years Cbia

What Do I Need To Enroll In Autofile For Connecticut Taxjar Support

Registering For Sales Tax Vat And Gst Stripe Documentation

How To File And Pay Sales Tax In Connecticut Taxvalet

Os 114 Fill Out Sign Online Dochub